Economics chair examines Hawaii's solar tax credit

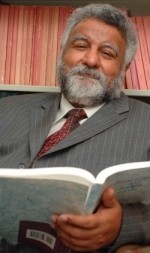

Radford University Department of Economics Chair and Professor Prahlad Kasturi has published “The Economic and Fiscal Impacts of Hawaii’s Solar Tax Credit” in the peer-reviewed International Journal of Economics and Policy.

Kasturi and co-author Thomas A. Loudat, an economist in Hawaii, wrote the paper to assess the fiscal and economic impacts of the state’s solar tax credit-simulated solar installations.

Their method involved estimating the economic effects created by the purchase of a solar system and measuring those against alternatives.

“Our study shows that the state receives full repayment of its solar credit investment in nine to 15 years,” Kasturi said. “For each solar credit dollar spent, the state receives $1.97 to $2.67 in additional tax revenues.”

The fiscal results of the tax credit reported by this research, Kasturi said, have been replicated in a federal solar tax credit study published by the U.S. Partnership for Renewable Finance USPRF in 2012. It estimates an internal rate of return (IRR) of 10 percent for the government’s tax credit “investment” in residential solar systems.

“The findings of the federal study comports closely with our Hawaii estimate of an IRR of 9.5 percent for residential and 11.1 percent for commercial solar systems,” Kasturi said.

The International Journal of Energy Economics and Policy is the international peer-reviewed academic journal, publishing high-quality, conceptual and measure-development articles about energy economics, energy policy and related disciplines.